work in process inventory balance formula

The work in process formula is. How to Calculate Ending Work In Process Inventory.

How To Calculate Finished Goods Inventory

WIP b beginning work in process.

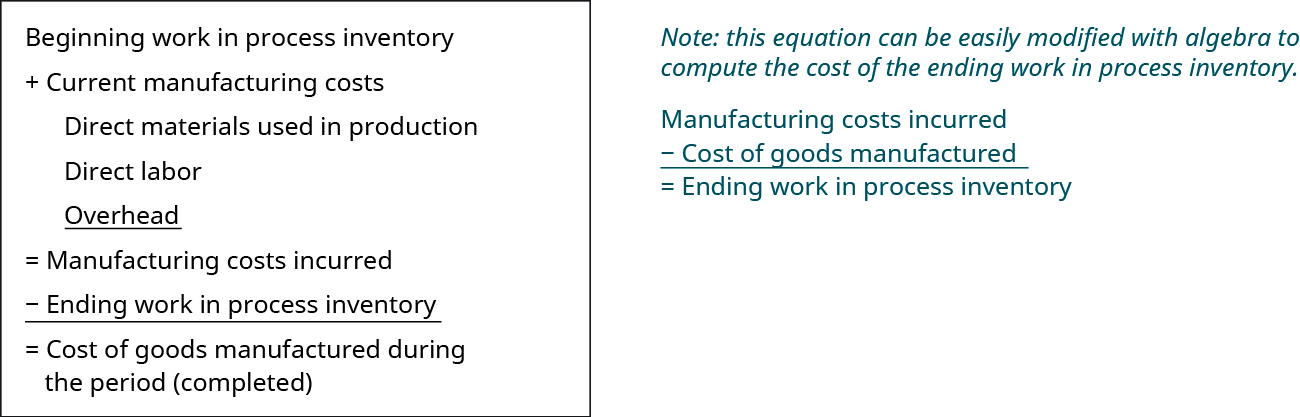

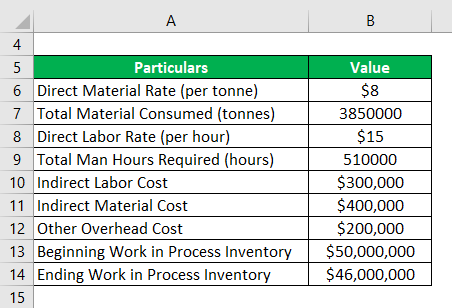

. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. Lets use a best coffee roaster as an example. So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet.

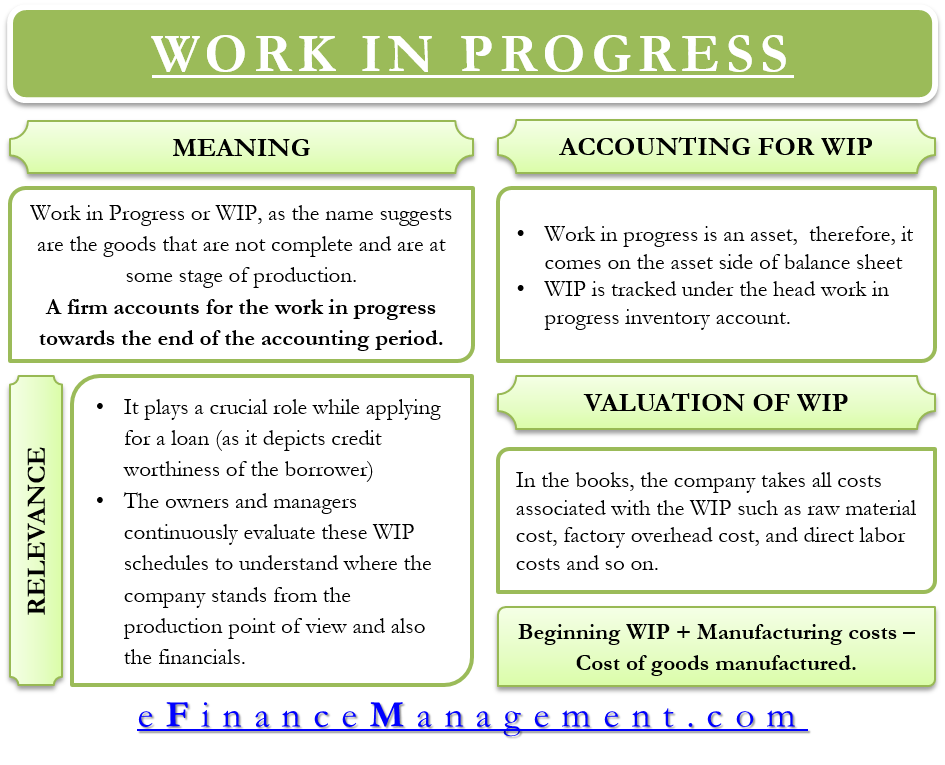

Charleston Company uses a job-order costing system. The formula is as followed. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead.

WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress. How do you calculate work in process inventory. Your WIP inventory formula would look like this.

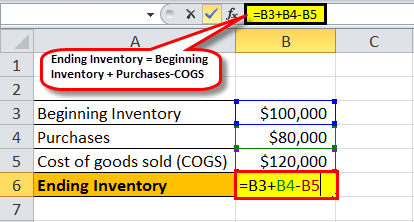

Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. The formula is as follows. Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold.

Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. Work in progress also called work in process is inventory that has begun the manufacturing process and is no longer included in raw materials inventory but is not yet a completed product. 8000 240000 238000 10000.

Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Imagine BlueCart Coffee Co.

The value of the partially completed inventory is sometimes also called goods in process on the balance sheet. The WIP figure reflects only the value of those. The formula for calculating the WIP inventory is.

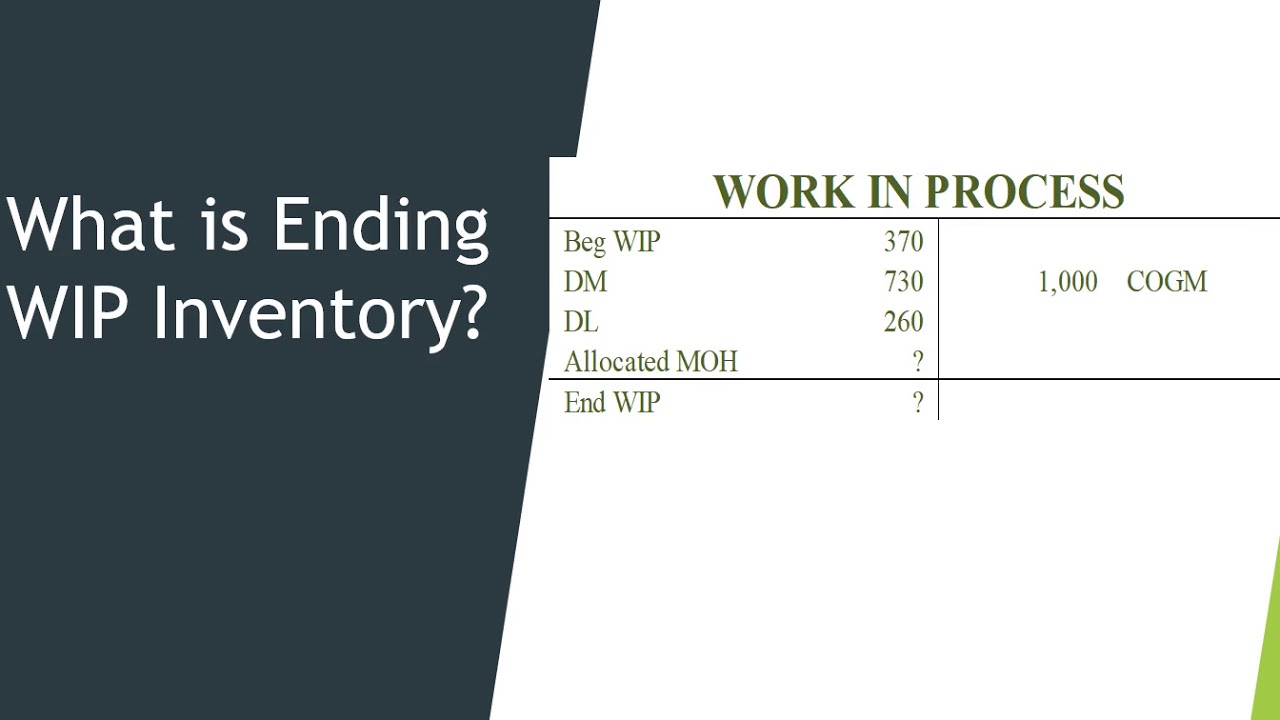

During April the following costs appeared in the Work in Process Inventory account. Work in process inventory formula. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

Suppose you have allocated 10 per widget for overhead and the direct labor and materials costs total 40 giving a unit production cost of 50. The formula for WIP is. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue. 12312017 The ending work-in-process inventory on December 31 2017 is 670000. The process of converting raw materials into finished products costs your company in time and money.

And C c cost of goods completed. The work in process formula is expressed as. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods.

Formulas to Calculate Work in Process. Work in process inventory and work in progress inventory are interchangeable phrases for the most part. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory.

Though some within supply chain management do make a small distinction between them. Every dollar invested in unsold inventory represents risk. The proportion of the unit cost is the overhead of 10 divided by the 50 total cost or 020.

WIP e WIP b C m - C c In this equation WIP e ending work in process. ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. Ending Inventory Beginning Balance Purchases Cost of Goods Sold.

The formula for this is as follows. 4000 Ending WIP. Higher sales and thus higher cost of goods sold leads to draining the inventory account.

The formula for ending work in process is relatively simple. Multiply the balance of work in process by 020. Work in process inventory calculations should refer to the past quarter month or year.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. This means that Crown Industries has 10000 work in process inventory with them. Has a beginning work in process inventory for the quarter of 10000.

Take a look at how it looks in the formula. WIPs are considered to be a current asset on the balance sheet. On a balance sheet work in progress is considered to be an asset because money has been spent towards a completed product.

C m cost of manufacturing. Work in process WIP work in progress WIP goods in process or in- process inventory are a companys partially finished goods waiting for completion and eventual sale or. Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Costs - Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of the total inventory produced during a period and is ready for the purpose of sale.

For the exact number of work in process inventory you need to calculate it manually. Beginning balance 24000 Direct material used 70000 Direct l. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured.

Its ending work in process is. If your ending WIP equals 20000 you have 20000 times 020. Keep in mind this value is only an estimate.

However by using this formula you can get only an estimate of the work in process inventory. Some folks refer to work in process inventory only in the context of production operations that move along relatively quickly. Also Know what does work in process mean.

Work in process inventory 60000. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. Add the new purchases and subtract the Cost of goods sold.

10000 300000 250000 60000.

What Is Work In Progress Wip Finance Strategists

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Work In Process Wip Inventory Youtube

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Cost Of Goods Manufactured Formula Examples With Excel Template

Ending Inventory Formula Step By Step Calculation Examples

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Work In Progress Meaning Importance Accounting And More

Inventory Formula Inventory Calculator Excel Template

Ending Inventory Formula Step By Step Calculation Examples

Ending Work In Process Double Entry Bookkeeping

Solved Calculate The Ending Work In Process Inventory Chegg Com

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template